That means that every year a city the size of Tallahassee proudly parades its new breasts in front of boob tube America. The actual breast augmentation figure is considerably higher due to poor survey response rates, as explained in our Facial Rejuvenation story. Medical tourism to Mexico and South America further impacts the total.

BBC News reported that 1.5 million women underwent the procedure worldwide in 2010. In the U.S., a combined total of 280,124 breast augmentation and breast lift procedures placed breast enhancement ahead of liposuction in 2020 as the most popular cosmetic surgical procedure.

Manufacturers

There are three manufacturers that market breast implants in the U.S.:

- Natrelle INSPIRA – Dublin-based Allergan plc is famous for its Botox injectables and Juvederm dermal fillers. Riding on their coattails, Allergan has become the largest breast implant manufacturer in the world, with estimated annual revenues of $260 million in 2021. It got there by buying breast implant maker Inamed in 2005 for $3.2 billion. In January 2017, Allergan received FDA approval to market Natrelle INSPIRA breast implants, available in three levels of “cohesivity” or firmness. The standard Natrelle INSPIRA has a cohesivity level of 1. A medium firmness gel, with a cohesivity level of 2 is the Natrelle INSPIRA Cohesive. Finally, the Natrelle INSPIRA SoftTouch has a cohesivity level of 3. Besides firmness level, Natrelle gel implants come in 100 sizes and five “projection profiles,” which results in hundreds of different choices. In May 2020, Chicago-based AbbVie acquired Allergan for $63 billion.

- MENTOR MemoryGel Xtra – In early 2022, Irvine, Calif.-based MENTOR Worldwide LLC will offer MENTOR MemoryGel BOOST, which the company claims studies have shown feels “more natural compared to another leading brand.” MemoryGel BOOST combines MENTOR’s highly cohesive gel, an innovative implant shell design, and precision fill ratio, providing increased form stability to shape the breast. MENTOR is owned by Johnson & Johnson, which acquired the company for $1.1 billion in December 2008. MENTOR generates about $140 million in annual earnings. More than 7 million women worldwide have chosen MENTOR breast implants since their 1988 debut, when the company was known as Inamed (and formerly McGhan Medical).

This video describes Mentor’s MemoryGel Xtra implants to a doctor audience but is useful for prospective implant patients as well.

- Sientra – Sientra Inc. of Santa Barbara, Calif. was founded in 2006 to originally distribute silicone implants manufactured by Brazil-based Silimed. Doctors around the world had been using Silimed’s breast implants for more than 25 years. In 2012, Sientra received FDA approval for a silicone gel implant that uses a branded TRUE texture — Silimed’s proprietary texturing technology designed to promote better tissue adherence. These implants are also known as “gummy bear” breast implants due to their teardrop shape, which provides more natural-looking breasts post-surgery. In 2019, Sientra acquired Franklin, Wisc.-based Lubrizol Life Science, allowing the company to manufacture its own implants. The company generated net sales of $55 million for its breast products in 2020.

Material

The first breast augmentation occurred 60 years ago, when Timmie Jean Lindsey, a mother of six, received silicone implants at Jefferson Davis Hospital in Houston, Tex. in the spring of 1962. Ever since then, silicone has played a, pardon the pun, material role in the manufacture of breast implants.

Plastic surgeons Thomas Cronin and Frank Gerow used a supply of silicone donated by Dow Corning as source material. The original design of breast implants has undergone significant changes in the six decades since silicone was put to use. In the early 1980s, some women began complaining about breast pain and distorted breast shapes caused by their body’s reaction to implants. Implants cause connective tissue disorders called, “capsular contracture” and “calcification.”

Capsular contracture is the tightening of scar tissue that forms around a breast implant, which can lead to rupture. The scar tissue is considered normal and is known as the “capsule,” while “contracture” is the tightening. This is also frequently called the “hardening” of the breast due to implant surgery. Calcification, which presents as white-gray plaques on the inner surface of capsules, occurred in 100% of the 28 first-generation implants (1963-1972) analyzed, and 10% of 348 second-generation implants (1973-1987).

Unfortunately, the very advantage of second-generation implants, a thinner outer shell that resulted in far less calcification, also led to a rupture rate as high as 50% at 20 years.

In the late 1980s, thousands of plaintiffs prevailed against implant manufacturers, leading to a multi-billion dollar class settlement and the bankruptcy of Dow Corning in May 1995. The controversy resulted in intense scrutiny of safety and efficacy by the Food and Drug Administration (FDA) and a ban on silicone breast implants that lasted 14 years, from April 1992 until November 2006.

Despite the 1992 FDA ban on silicone breast implants, breast augmentation remained the third most common cosmetic operation in the U.S. in 1994 due to the substitution of saline breast implants.

The most significant innovation may well be the 2001 introduction of fifth-generation “cohesive” gel implants. These implants are unique due to the degree of “cross-linking.” Gel cohesiveness is determined by the amount of cross-linking with the silicone gel filler: the more cross-linking, the more cohesive the gel and the firmer it is. This helps it maintain its shape, according to Mentor.

Shape

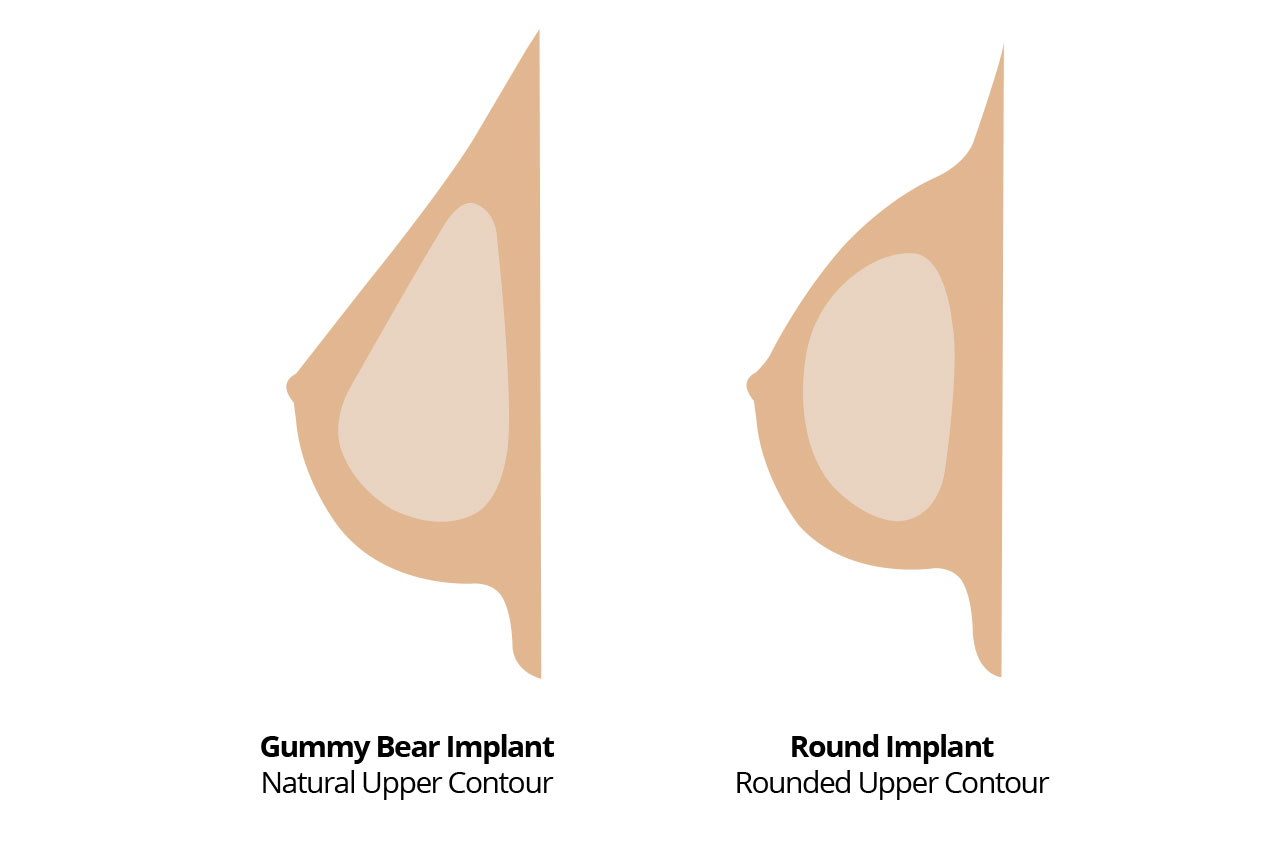

The first thing you need to know when shopping for new breasts is the term “gummy bear implants” — a nickname for teardrop-shaped, cohesive gel-based implants. Cohesive gel implants are known to retain their shape better than other types of breast implants made from saline and earlier silicone types. The term has caught on so much that Natrelle even classifies its three implants as “Gummy, Gummier, and Gummiest.”

A tear-drop-shaped breast implant offers a more natural shape than a round implant, and due to the resemblance to gummy bears, its nickname has caught on.

A tear-drop-shaped breast implant offers a more natural shape than a round implant, and due to the resemblance to gummy bears, its nickname has caught on.

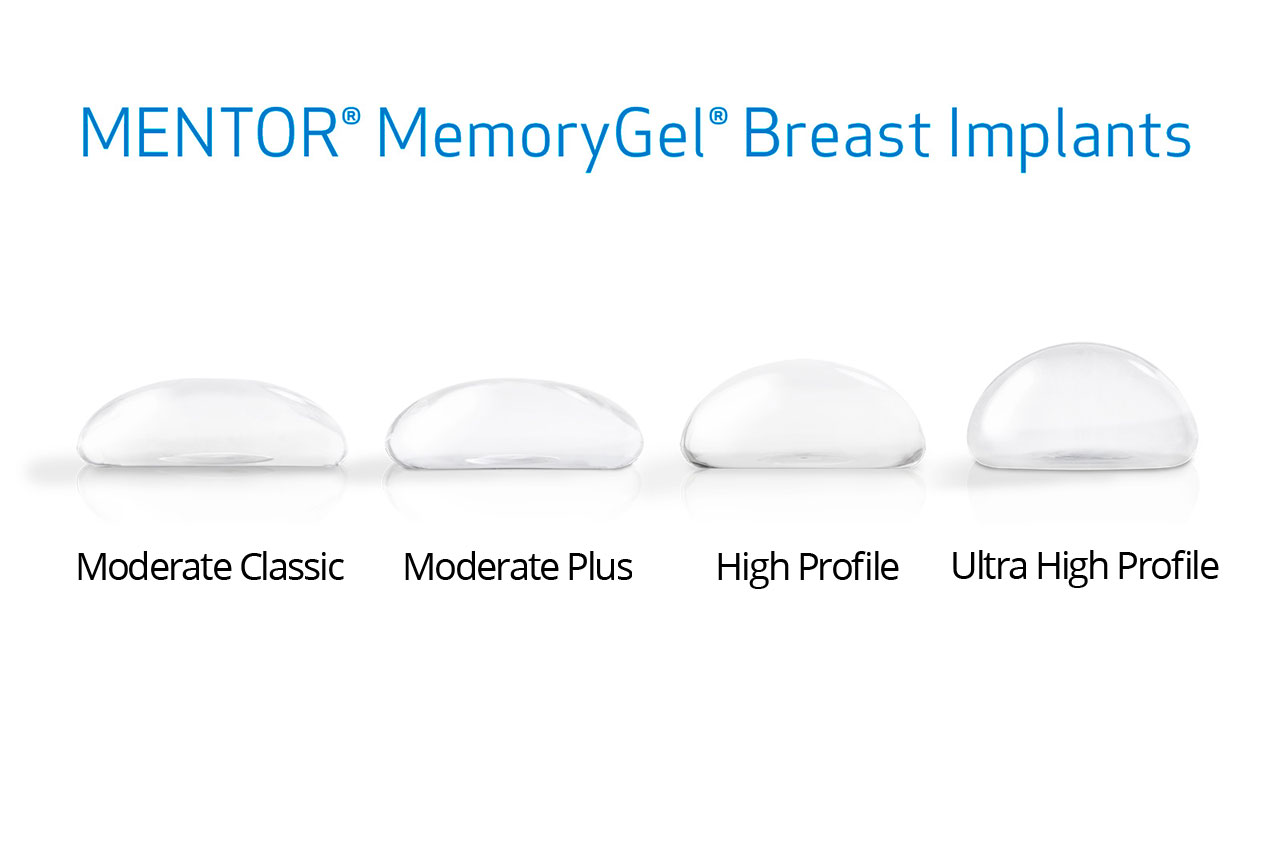

Another concept to familiarize yourself with is profiles. The two basic implant shapes, gummy bear and round are available in varying degrees of projection, known as profiles. A breast implant profile refers to the level of forward projection from the chest. A high-profile breast implant will create a more prominent silhouette than either a moderate, called “Classic” in the image below, or moderate-plus breast implant of the same size, which is metrically expressed in cubic centimeters.

Breast implants are available in as many as five different profiles. Here four MENTOR profiles, Moderate Classic, Moderate Plus, High Profile and Ultra High Profile, are used to show the differences in forward projection each breast implant profile offers.

Breast implants are available in as many as five different profiles. Here four MENTOR profiles, Moderate Classic, Moderate Plus, High Profile and Ultra High Profile, are used to show the differences in forward projection each breast implant profile offers.

Placement

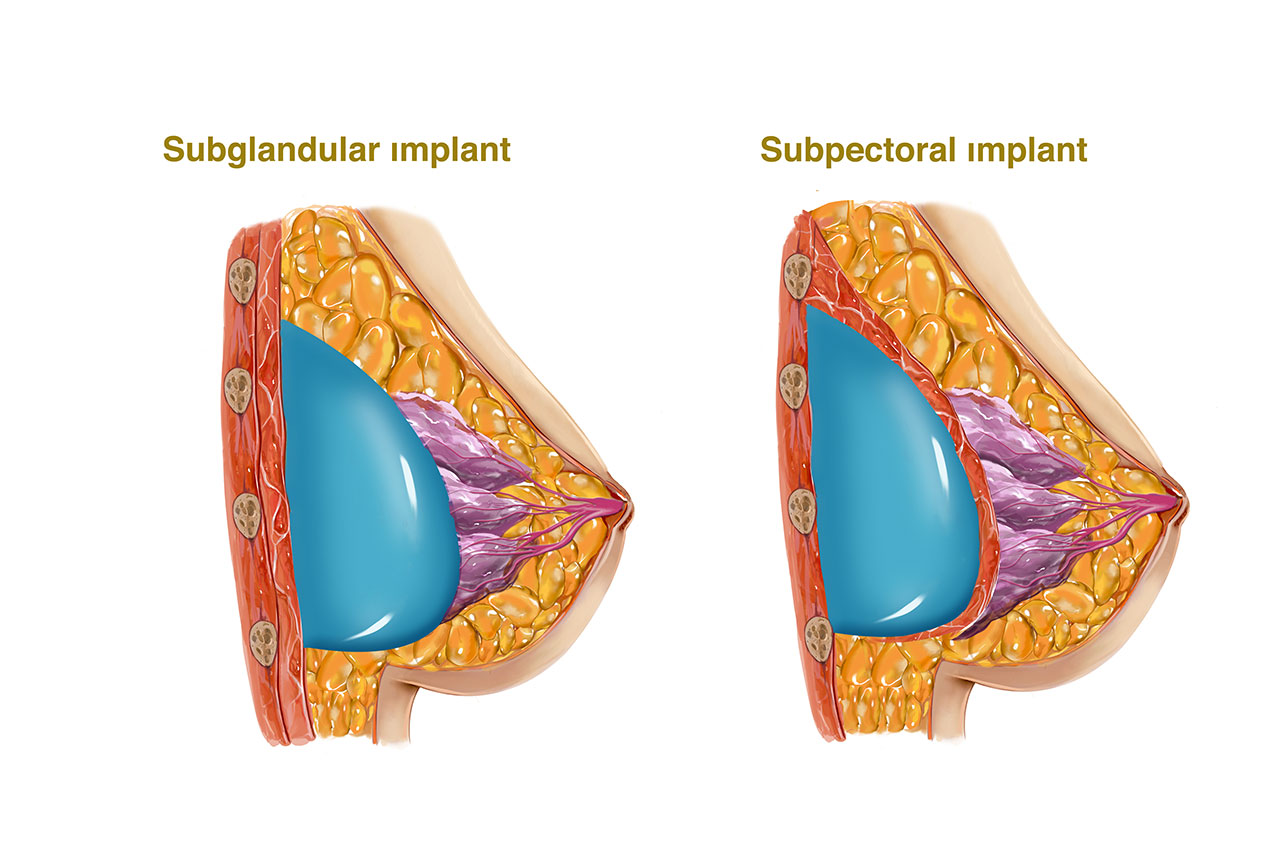

There are two choices to be made when it comes to placement of a breast implant, subglandular and submuscular, over or under the pectoral muscle, respectively.

Subglandular

When implants are placed above the muscle, capsule contracture rate can be as much as six times higher. To reduce contracture rate in above-muscle placements, some surgeons offer textured breast implants. However, each technique has its advantages and disadvantages:

Pluses

• Better breast projection and shape

• Decreased pain after surgery

• The implant does not move when chest muscles are contracted

Minuses

• Increased rate of capsular contracture

• Increased risk of palpable implant if skin and breast are too thin (palpable is the “rippling” effect frequently seen in breast implants)

Submuscular

Some surgeons recommend placing it under the muscle as studies have shown that this technique results in softer and more natural-looking breasts, a lower risk of capsule contracture, and improved long-term results.

Pluses

• Decreased rate of capsular contracture

• Better view of breast during a cancer-screening breast mammography

Minuses

• Slightly more pain after surgery than subglandular placement

• Possible implant movement with contraction of the chest muscles (known as breast animation)

Some surgeons recommend placing it under the muscle as studies have shown that this technique results in softer and more natural-looking breasts, a lower risk of capsule contracture, and improved long-term results. When implants are placed above the muscle, capsule contracture rate can be as much as six times higher.

Some surgeons recommend placing it under the muscle as studies have shown that this technique results in softer and more natural-looking breasts, a lower risk of capsule contracture, and improved long-term results. When implants are placed above the muscle, capsule contracture rate can be as much as six times higher.

Keller Funnel 2

To safely place silicone breast implants, many surgeons rely on the Keller Funnel 2, which allows for a smaller incision, no-touch delivery, and less trauma to breast implants and breast during surgery. Prior to the invention of the Keller Funnel, a plastic surgeon would have to use their fingers to push an implant into the breast pocket. Each pressure point could potentially weaken the implant’s shell. Use of the Keller Funnel circumvents these issues, typically resulting in less discomfort and a faster recovery.

Most plastic surgeons include Keller Funnel 2 in their cost of supplies. In June 2017, Allergan Sales LLC acquired Keller Medical Inc., maker of the Keller Funnel, for an undisclosed sum.

Cost

The real reason why more women are not pursuing breast augmentation is due to cost. RealSelf reports that the average cost of a breast augmentation procedure among its community members is $6,550, but if you live in a glitzy city like Los Angeles you could easily be talking $12,000-plus.

Warranties

All that talk about ruptures and revision surgery has led to a host of warranties each of the three U.S. manufacturers provides:

Warranty Policy Comparison

| Incident | Allergan | Mentor | Sientra Platinum20 |

| Rupture | Lifetime affected and contralateral implants replacement; 10 year out-of-pocket financial assistance of up to $3,500 | Lifetime affected and contralateral implants replacement of same style; 10 year financial assistance of up to $3,500 | Lifetime affected and contralateral implants replacement; 20 year uncovered fees and costs of up to $5,000 |

| Capsular contracture (Baker grade III/IV) | 10 year affected and contralateral implants replacement; 2 year out-of-pocket financial assistance of up to $2,000 | 10 year affected and contralateral implants replacement of same style | 20 year affected and contralateral implants replacement; 2 year uncovered fees and costs of up to $2,000 |

| Double capsule | — | 10 year affected and contralateral implants replacement of same style | 20 year affected and contralateral implants replacement; 2 year uncovered fees and costs of up to $2,000 |

| Late-forming seroma complications | 20 year affected and contralateral textured implants replacement; Out-of-pocket financial assistance of up to $1,000 for diagnostic testing (textured implants only) | 10 year affected and contralateral implants replacement of same style | 20 year affected and contralateral implants replacement; 2 year uncovered fees and costs of up to $2,000 |

| Breast implant–associated anaplastic large cell lymphoma (BIA-ALCL) | Lifetime affected and contralateral implants replacement; Out-of-pocket financial assistance of up to $7,500 for treatment | 20 year affected and contralateral implants replacement; 20 year uncovered fees and costs of up to $7,500 |

Sources:

Allergan

Natrelle ConfidencePlus gel warranty program

Mentor

MENTOR Warranty